Disclosure: This post may contain affiliate links, meaning we get a commission if you decide to make a purchase through our links, at no cost to you. Please read our disclosure for more info.

Last Updated on March 29, 2017 by Work In My Pajamas

If history is any guide, it’s true that for many decades doing business as a woman was harder. There were less options for females, and fewer dollars too. But today, the number of female business owners is quickly growing. Between 1997 and 2014, when the number of businesses in the US increased by 47%, the number of women-owned firms increased by 68%. Although the number of women-owned firms continues to grow, women-owned firms still employ just 6 percent of the country’s workforce and only contributes under 4 percent of business revenues as of 2014.

Luckily, some innovative approaches to financing business are aiming to help women find the cash they need to build and grow their businesses. Many of these are grants, which can provide critical financing in order to expand or even to start a business.

Not all grants are specific to female-owned businesses, and not all female-owned businesses can apply for all grants. For example, some grants may bind recipients to business activity in a certain area. Some may focus on a type of business, and many require a particular business size.

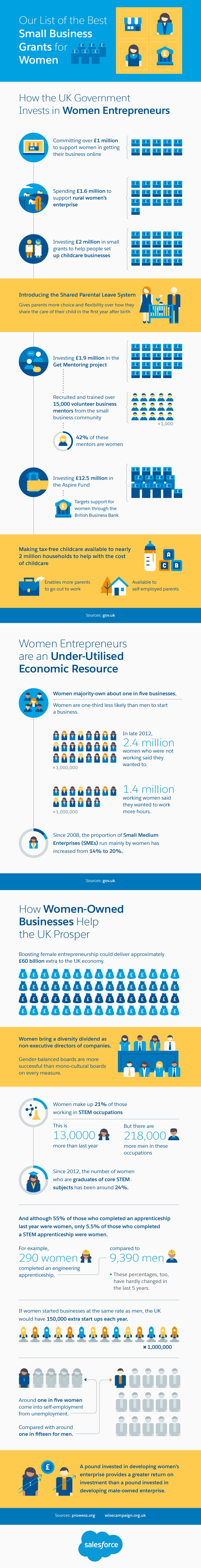

Want to learn more about potential small business grants for women that you can use to grow your business? This graphic can help.

Infographic via Salesforce | Introductory statistics via NAMBO